Trump’s nominee to lead the SEC comes from a deep corporate background. Will he serve the people or Wall Street as Chair?

Sample Social Media Posts

Jay Clayton’s nomination for SEC chair is scheduled for March 23. Urge the Senate Banking Committee to vote no: ResistTheHostileTakeover.org

.@SenSherrodBrown is right: Jay Clayton is unfit to serve as chair of the SEC. Join the resistance: ResistTheHostileTakeover.org

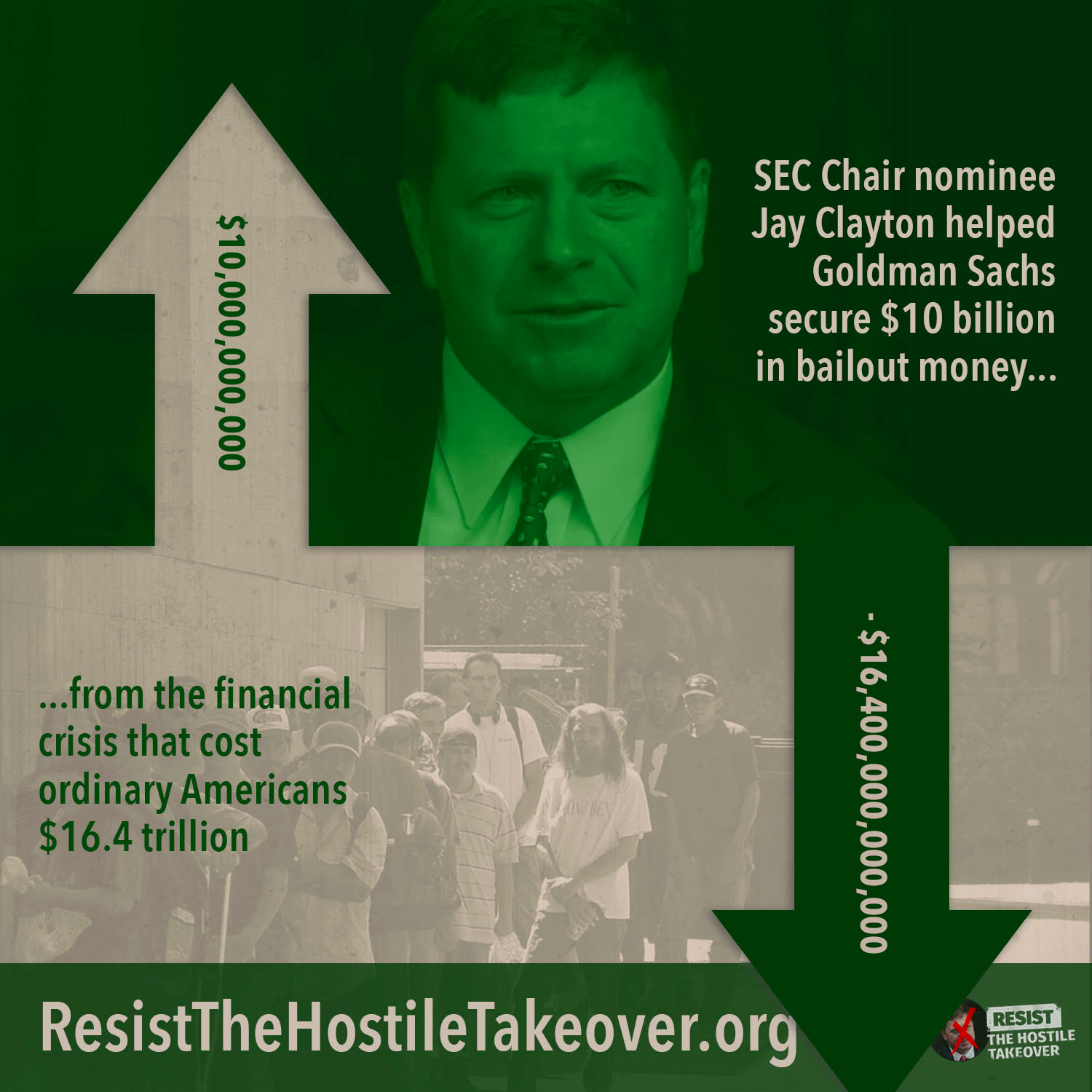

Jay Clayton & the banks he represented played a leading role in the 2008 financial crisis. Unfit to be chair of the SEC? Yes.

Jay Clayton, ex-Wall St. banker, is Trump’s nominee to police Wall St. Conflict of interest much? Tell the Senate: ResistTheHostileTakeover.org

.@Lisa_PubCitizen: will SEC chair nominee Clayton represent the people or be compromised by Goldman Sachs ties? http://nydn.us/2l3rfYU

Trump’s nominee for SEC Chair wants to ease regulations on Wall Street. http://on.wsj.com/2kOVxhX

Who is Jay Clayton? A Wall Street agent or responsible SEC Chair? Senators should ask these questions to find out. http://bit.ly/2kXDHfX

Trump’s nominee to head the SEC is married to the industry he’s supposed to police. http://rol.st/2iWSjeZ By @mtaibbi @RollingStone.