Corporate Investors Target Labor, Political Spending in 2024

This story originally appeared in Bloomberg Law. You can view the original article here.

By Clara Hudson | December 22, 2023

Labor rights, pay equity and political contributions are poised to take center stage at corporate annual meetings in 2024.

Shareholder proposals on workers’ rights are building on the momentum of a burgeoning labor movement, while proposals on political spending will see renewed attention as the presidential race gathers speed. The drive is especially notable considering that support for environmental, social and governance proposals took a hit overall this year, with an average of about 22% support down from 33% in 2021, according to a post-proxy season analysis from the Sustainable Investments Institute.

Following a labor-related win at Starbucks’ annual meeting in March, proposals voicing concerns about companies’ commitments to workers’ rights to organize are gearing up for their second year on the corporate ballot at annual investor meetings. And after Kroger investors passed a pay equity proposal in June, expect more companies to be urged to disclose additional details about how they pay women and minorities.

The shareholder momentum concerning how companies treat their employees coincides with highly publicized allegations of labor violations at companies including Starbucks, as well as worker pushback on pay transparency alongside a wave of state salary transparency laws.

“I think it’s undeniable at this exact moment that the labor rights issues are salient to almost every company,” said Kyle Seeley, head of stewardship at the New York State Common Retirement Fund.

The New York State and New York City Comptroller’s offices, which oversee public employee pension funds, this year secured results including 36% of investor support on a proposal asking Netflix to adopt a policy on its commitment to freedom of association and collective bargaining, a high level of backing for a shareholder bid. The proponents have refiled the Netflix proposal, which could go to another vote next year. Netflix declined to comment for this article.

Another batch of proposals to watch is those seeking more corporate transparency on political spending—particularly over how corporate donations line up with the values the companies tout. Those bids are likely to get heightened attention because of the upcoming presidential election.

The comptroller’s office also focused this year on political spending bids at companies like Warner Bros. Discovery Inc., which agreed to publicly disclose its political spending in May. When Seeley speaks to businesses about their donations, his “main point” now is that the presidential election will increase transparency pressure, he said.

“This is a highly politicized action no matter who you make donations to,” he said.

Many of these proposals highlight how corporate donations are supporting candidates or groups that have worked to restrict abortion access. Investor interest in asking companies to report risk concerning abortion restrictions has slipped sharply since the Dobbs v. Jackson Women’s Health Organization decision.

The dozen or so abortion proposals that went to a vote at companies including UPS, PepsiCo and Coca-Cola, averaged 11.8% shareholder support during this year’s proxy season, cut in half from 25.1% the year before. Those proposals were garnering far more support before the Supreme Court overturned Roe v. Wade. Some proxy experts have theorized that the slump in support for ESG proposals overall, which coincides with the Republican backlash over the concept, is to blame.

Unions and Pay Equity

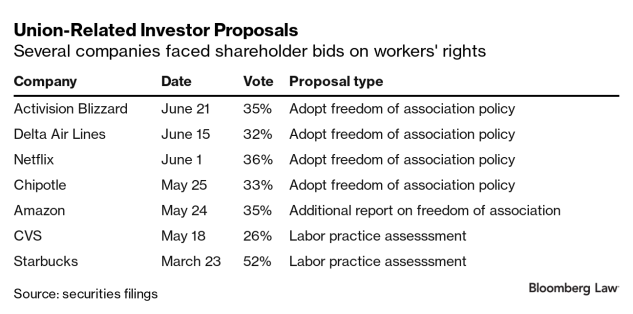

This past year there were about a half-dozen union-related investor proposals that went to a vote as workers went on strike from Hollywood to Detroit and public scrutiny flared up over allegations of union-busting.

Meanwhile, the New York City comptroller’s office last month announced a new international investor network calling on companies to respect workers’ rights. The network includes members like the UK-based Local Authority Pension Fund Forum.

The New York city and state comptroller’s offices have their eye on more companies: they recently took aim at online marketplace eBay Inc., asking the company to restore language to its website spelling out its support for employee union rights.

This year, companies including Activision Blizzard, Amazon and CVS faced investor votes on labor rights at their annual meetings. Those proposals, seeking either a freedom of association policy or a labor practice assessment, secured a steady amount of investor support, typically in the 30-36% range, except for CVS which garnered 26% support.

Seeley said the comptroller’s office has refiled the CVS proposal, which could go to another vote next year. In its proxy statement, CVS said it publicly discloses compliance with its human rights policy and its approach to protecting workers in its supply chain. CVS said it is “committed to workers’ freedom and collective bargaining rights worldwide and our policies reflect that commitment.”

In an email, CVS added: “We have good relationships with the unions that represent our colleagues and have ratified over 15 agreements in the past three years, with no work disruption. We have no pattern or practice of anti-union behavior, and in fact, have business lines that are actively dedicated to serving the needs of public and labor clients and members.”

A proposal calling for a labor practice assessment at Starbucks, which has been enmeshed in a highly public controversy over alleged labor violations, also stood out this year for winning majority investor support with 52%. Prompted by the proposal’s win, Starbucks released an independent report in December that found the company could improve its communication and management training on labor issues.

Starbucks said the report shows it “is not opposed to bargaining and continues to engage in meaningful negotiations with other unions elected to represent our partners.”

A shareholder proposal at Kroger to increase pay equity transparency was another of the standout bids this year that won. The Kroger proposal may have passed the 50% mark in part because of articles about Kroger workers who were homeless or on foodstamps.

The proxy push coincides with new laws adopted in states such as California and New York that mandate transparent pay information and are intended to give workers more bargaining power to fight pay discrimination.

Similar proposals to the bid at Kroger targeted companies including Nike, Apple and Amazon, typically securing about 30% shareholder support this year.

The charge was led by impact investment firm Arjuna Capital, which has brought bids that could go to another vote next year at Amazon, for example. Amazon declined to comment.

“It’s not enough to say we care about our employees, you have to prove to your employees that you are treating them equitably,” said Julia Cedarholm, senior associate of ESG research and shareholder engagement at Arjuna Capital.

Amazon said in its proxy statement this year that it already “provides extensive statistical reporting on our workforce diversity and pay equity… We do not believe that the additional report on vaguely-described ‘median pay gaps across race and gender’ requested by this proposal would enhance understanding of or accountability for our diversity efforts.”

Political Spending

With heightened political friction emerging because of the presidential election, companies are wrestling with more pressure over which candidates or third parties they’re funding.

A report published this month from the Sustainable Investments Institute (commissioned by non-profit consumer advocacy group Public Citizen) drew attention to the lack of clarity companies give on lobbying: the report said 98% of S&P 500 firms don’t disclose lobbying totals for specific states.

Companies including Coca-Cola, Home Depot and Eli Lilly faced a range of political spending-related proposals this past year. The proposals asked Coca-Cola and Home Depot if their donations match their corporate values, and sought a policy at Eli Lilly requiring that third parties to which it donates, including trade associations, reveal where the money goes.

A proposal at Disney asking the entertainment giant to unveil details about how its political donations match its values secured 36% of investor support at its annual meeting in April. The vote came around the time that Disney publicly clashed with Florida Governor and presidential hopeful Ron DeSantis (R) over its response to the state’s “Don’t Say Gay” law, which limits classroom discussion of sexual orientation.

At the time, Disney said in its proxy statement that the proponent “is seeking to micromanage the company’s political engagement to advance a limited, particular agenda rather than recommend an action to enhance shareholder value.”

One proposal at Caesars Entertainment Inc. secured a strong showing of shareholder support with 42% voting for a proposal asking the company for more information about its political spending.

And there were some corporate compromises that led the New York State comptroller to withdraw its proposals: a string of companies including Warner Bros., Match Group Inc., Paramount Global, PENN Entertainment Inc., Zillow Group Inc. and Zoom Video Communications Inc. said this year that they will publicly report monetary and nonmonetary contributions to any campaign for or against a candidate, or to influence public opinion on an election or referendum.

Companies should take notice that transparency and accountability “is very important in terms of their image but also in terms of protecting themselves,” said Bruce Freed, co-founder and president of the Center for Political Accountability, which has written model proposals for shareholders seeking more political spending transparency.

“They realize today how they can be impacted by what their spending enables and what it associates them with,” he said. “Especially going into an election that has such consequences.”