Your 401(k) might hold the key to fighting corporate power

Since the 2016 election ushered in the Businessman- in- Chief, America has witnessed just how far the rich and powerful are willing to go to protect their interests at the expense of everyone else. The President thinks he is exempt from the clause in the Constitution which says he cannot receive foreign monies that could constitute bribes, and has refused calls for him to separate himself from his personal business dealings to ensure that he doesn’t profit from the presidency. By refusing to let go of his businesses he has shown the American people that he is willing to prioritize his own profits over the nation’s prosperity, security, and future.

Many Americans are finding it chilling to watch the President of the United States and certain members of Congress blatantly choose corporate interests over basic human ones. For example, the President and Republicans in Congress are pushing a healthcare bill that will benefit the insurance and drug companies while denying Americans with pre- existing conditions coverage. In America, the corporate motive to make profits can sometimes be in tension with the human motive to keep people safe, healthy, and able to pursue happiness in a functioning democracy. It’s difficult to dissect all the ways bad apples try to game the system to benefit their corporate bottom lines at one time, so this post explores just one of those ways and offers an opportunity for regular Americans to fight back.

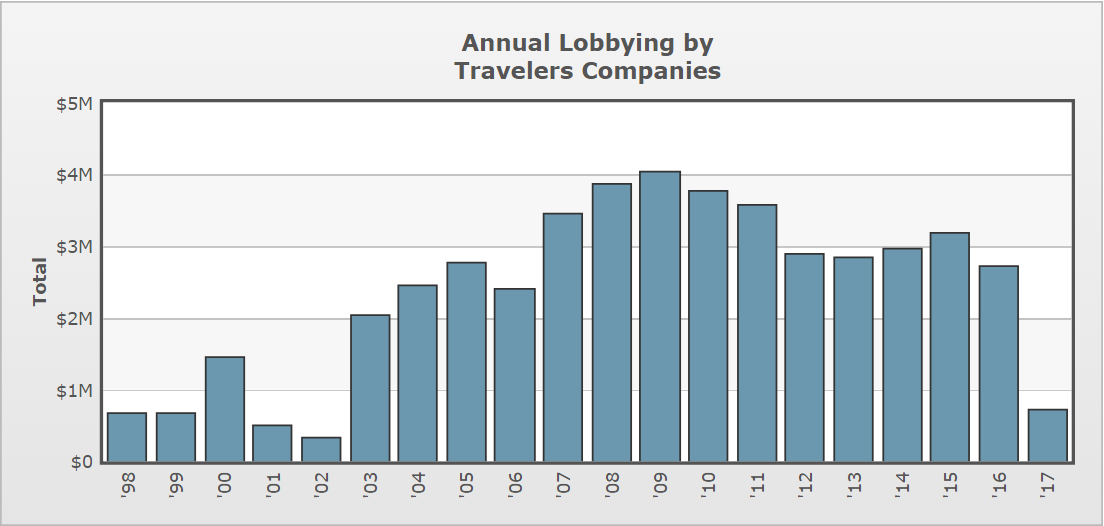

This week, the insurance giant Travelers Companies is holding its annual shareholder meeting. For the last decade the company has spent between $2.7 million and $4 million annually on federal lobbying on issues like taxes, banking, insurance, and the federal budget. At the state level it’s much harder to know exactly how much the company spent because disclosure requirements at the state level are uneven and data is hard to digest. To alleviate that problem, the company should make this information readily available to its shareholders, which is what investors are asking for in the form of a shareholder resolution that is up for a vote at this year’s meeting.

Source: The Center for Responsive Politics. https://www.opensecrets.org/lobby/clientsum.php?id=D000021773

Source: The Center for Responsive Politics. https://www.opensecrets.org/lobby/clientsum.php?id=D000021773

In the supporting statement for the proposal proponents also cite Travelers’ undisclosed involvement with trade associations, which lobby on behalf of their members. Some of these trade organizations are incredibly heavy hitters in Washington, D.C., roaming the halls of Congress pushing for fewer regulations and the rollback of public protections. The U.S. Chamber of Commerce is one of these heavy hitters, spending over $100 million on federal lobbying in 2016 alone. As a member of the Chamber, Travelers should disclose to shareholders exactly how much it pays the trade association to lobby on the company’s behalf as association with the Chamber can pose a risk to the company’s reputation. As a large property insurer, Travelers is exposed to the myriad risks associated with climate change, but the Chamber (funded by Travelers) sued to block the EPA Clean Power Plan, which was designed to curb the catastrophic effects of climate change.

If you own shares directly in Travelers you should vote in favor of shareholder proposal #6, which asks the company to prepare an annual report on its lobbying activity so that shareholders- the true owners of the company- can assess the associated risk.

If you don’t own stock directly in Travelers, (or any other company where these types of shareholder resolutions are filed this year), but are worried about the secret way corporations are attempting to influence our democracy, chances are you can have an impact through your 401(k) instead.

Vanguard, BlackRock, Fidelity and the other large mutual fund companies are in a position to move the needle on this issue. As the largest managers of retirement savings these mutual fund giants control significant voting shares in America’s most powerful companies. Vanguard, for example, controls over 20 million shares, or 7.36% of Travelers’ common stock. Yet, Vanguard consistently votes against shareholder proposals that attempt to bring corporate political activity into the light. A recent Public Citizen report illustrates just how detrimental the mutual fund companies’ decisions to support corporate executives on these issues are. In 2016, 64% of political spending disclosure shareholder resolutions at companies where mutual funds own more than 5% of common stock would have received majority support if those mutual funds had voted their shares in support of the resolutions. If you invest your retirement through Vanguard, tell the company to change the way it votes so that progress on disclosure can move forward.

The deck may appear to be stacked in favor of big corporate interests, but as Senator Elizabeth Warren said recently, we have been here before over a century ago and we fought back. “Teddy Roosevelt earned the title Trust Buster as he fought back against powerful monopolies that wielded huge influence over our government—and the reformers won,” said the Senator.

One way we will fight back and win is by bringing corporate lobbying out of the shadows and into the blazing sunlight, and we’ll start at Travelers.